Christos Papoutsy

Christos Papoutsy

|

Ethical business behavior has become a complex global challenge. Overnight hundreds of ethics associations have emerged, most claiming to know how to operate a business ethically. Business ethics and how to operate a “corporate socially responsible” business have become a flourishing business, with hundreds of books and seminars being sold worldwide to businesses, financial institutions, and universities. A contemporary glossary has been reborn suddenly from an old vocabulary. Words and phrases such as oversight, bubble, global humanization, moral compass, brute capitalism, cooking the books, citizenship responsibility have become part of the new business ethics language, intended to provide stakeholders with a more transparent understanding of the type of corporation with which they are associated. Much has been accomplished recently with the rapid enactment of new laws and regulations designed to significantly reduce corporate fraud. In the United States, Congress adopted the Sarbanes-Oxley Act of 2002, a comprehensive, wide-ranging law that affects nearly every aspect of the corporate governance of publicly held U.S. corporations. The New York Stock Exchange and NASDAQ adopted comprehensive new corporate governance regulations which substantially change the way corporations disclose information to stockholders and the public. The SEC has instituted a requirement obligating CEO’s and CFO’s of public companies to certify legally that their financial statements and reports are accurate and not misleading--exposing these executives to possible criminal charges if their numbers turn out to be bogus. Many large and small corporations have likewise acted quickly to adopt new practices by approving and implementing revisions to their governance structures, policies, and programs.

But questions of effectiveness linger in the minds of the stakeholders as they consider these public announcements. The changes still beg the central question: can morality be mandated? In other words, is moral capitalism possible? Despite the fact that many unanswered questions and unknown risks remain, changes in the laws and regulations, with concurrent emphasis on business ethics and corporate social responsibility, serve as a valuable major step in offering hope and instilling confidence in the stakeholders of most small and large businesses.

Finance, the providing of money to enterprises in the form of high-risk equity or lower-risk debt, drives capitalism. Even moral capitalism can’t survive without access to money. Owners and investors, the providers of capital, are as necessary for business success as all other stakeholders. Because their critical investments in any corporation are linked to public trust and confidence, the operation of a private or public corporation in the complex global community has brought on new challenges for business leaders to behave more ethically and responsibly.

Yet, in order for the global community to operate more ethically, there must be a set of commonly accepted standards. To date, no such common system exists. The business world still needs to take up a codex of acceptable business principles that will serve as a universal common denominator of business ethics. Among those actions which will likely occupy a pivotal role in the development of this set of rules are the laws and regulatory actions adopted recently in the US and the principles commendably established by such organizations as the Caux Round Table, an extraordinary international network of top business executives who advocate moral capitalism. Readers can view the principles of the Caux Round Table at the URL http://www.cauxroundtable.org/.

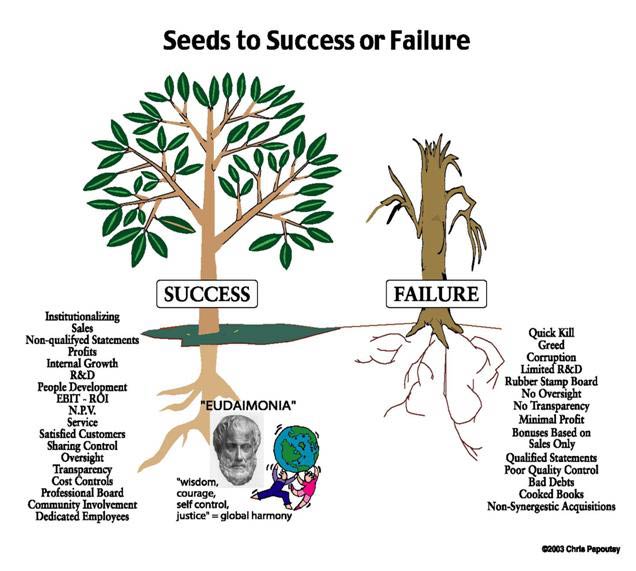

Despite public discourse on corporate corruption and efforts to restore public trust, corporate social responsibility is being practiced by individual companies and businesses. Let me share with you some of my own personal experiences in founding a small, home-based business, and setting a tone for fair business dealings. Under my leadership, our company grew over a number of years into a global corporation with over 1500 employees, thousands of customers worldwide, and annual sales of about $200 million dollars. We generated profits above industry standards for over twenty consecutive years. Our company, however, was never engrossed in any litigation and was recognized as an ethical corporation. At that time, we didn’t know we were operating a Socially Responsible Corporation. We were just trying our best to do the right thing. The pragmatic approach that we utilized resulted in handsome returns for all the investors, employees, customers, vendors, and our own community. A distillation of our basic precepts is as follows:

The Papoutsy Set of Common-Sense Rules for the Operation of Businesses

Institutionalization

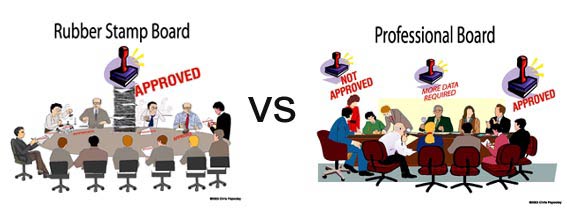

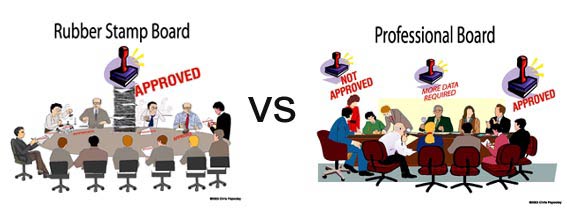

From the outset, my small company was organized as though it was a large, publicly-held corporation. We established a professional board of directors which included a mixture of highly respected, competent individuals who possessed values and enthusiasm and who participated actively. It was a professional board where disagreement was a virtue, not a vice. Unfortunately, few owners then--and now--wanted to share control with a professional board of directors. Institutionalizing meant sharing control with full transparency and real oversight.

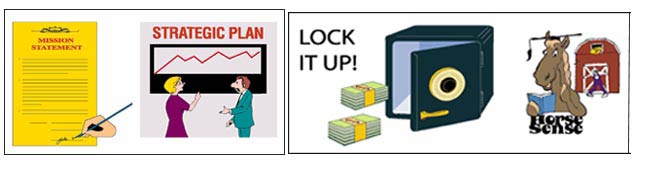

Adoption of solid business practices

The implementation of solid business practices will contribute significantly to the operation of an efficient, profitable, and socially responsible corporation. Without these solid practices, much can run awry, resulting in theft and deception within the corporation. There is an old saying in the business community that if you let someone steal from you, then you are almost as guilty as the thief. This business precept is a variation of the old agrarian adage, “Why lock the barn door after the horse has run away?” The CEO or CFO and the board need to oversee the company’s operations closely.

• Implementation of a Quality Control System

Every company that makes a product or provides a service should have a quality control system. The inspection department, for example, should check the quality and/or service at various points during manufacture and beyond the finished stage. However, if quality control standards are violated by a management team that directs deviation from standards, this can initiate a number of seriously unethical and bad business actions and can create mistrust between management and the inspection department and its employees. The result may be increased costs in labor, parts, warranty costs, returned goods, extension of accounts receivables, poor cash flow, and unhappy customers—all stemming from one unethical directive issued by management to violate quality control procedures. Customers are always at the heart of market capitalism. A business without satisfied customers is nothing more than someone’s fantasy of how to make a living.

•Proper training and management of sales personnel

The Sales Department is another important segment of the corporation; it can create ethical challenges leading to negative business results. The representations that company sales executives put forth to their customers can make or break a company. Sales personnel need to be trained and motivated to provide full and honest disclosure to customers about the capabilities of the product or service that they are marketing. Deviation from proper ethical and honest representations can result in increased service and warranty costs, returned goods, sluggish cash flow, and the loss of the all-important customer, the moral compass of capitalism. Incentives to all sales personal should be based not only on orders received, but also on the stipulation that these orders are paid and shipped to the customer, and on the cost to the sales department to obtain the order. Company executives should always be able to call upon that customer for a reference based on the satisfaction of the customer.

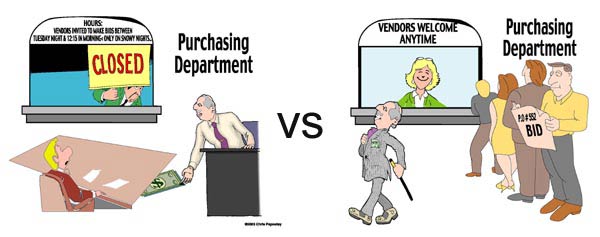

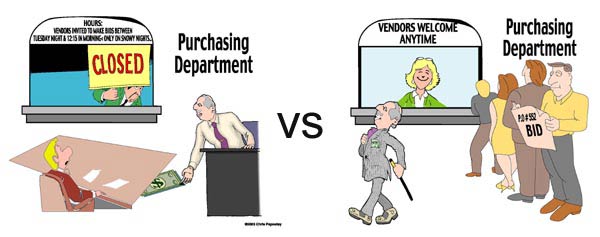

•Accountability and oversight of the Purchasing Department

Another very important area that requires close attention is the Purchasing Department where procedures for accountability and oversight are crucial. For example, each purchasing department should solicit from three to five quotes from vendors for every major purchase. If implemented, this procedure will result in reduced opportunities for bribery and corruption by the buyer and seller, improved quality of goods being purchased, lower costs, greater profitability, and enhanced respect of employees, vendors, and the community. Vendors and suppliers comprise a stakeholder constituency that is extremely important to the success of all businesses. A balance of interest must be negotiated with them to maximize the company’s ability to provide customers with quality components and services at an appropriate cost. A good, standard purchasing system and fair schedule for visitation of vendors can aide in establishing sound purchasing operations and oversight.

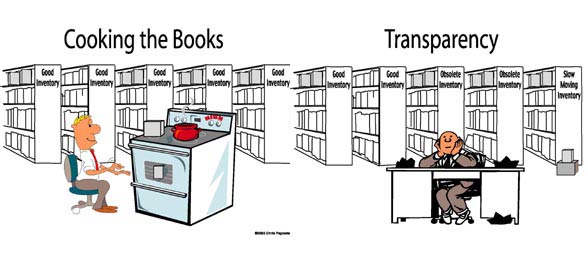

•Transparency of inventory

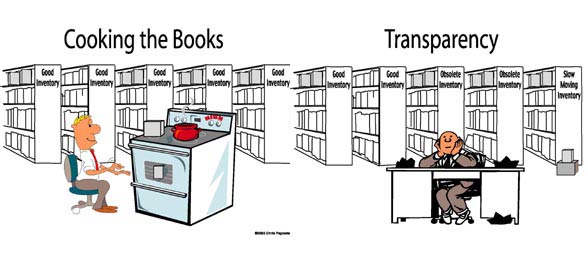

Another significant asset requiring attention, close control, and audits is the inventory. In many businesses, one of the biggest assets on the balance sheet is the inventory. All kinds of financial games can be played with how the inventory is valued and what is counted and not counted. This is one area where many companies have manipulated the balance sheet by “cooking the books,” by manipulating inventory values unethically to affect profits in a positive or negative manner. One company, for instance, may want to increase profits to demonstrate a continued good track record, while another company may want to decrease profits to avoid tax payments. Management has many “gray-area” techniques for manipulating their inventory. Good inventory control with surprise audits can be a deterrent for manipulation of inventory values.

•Employees: a company of citizens

All employees must be welcomed into the corporation as morally competent agents, seen as specially qualified for intelligent work, rather than as mere units of labor. Management and all employees must work together as responsible partners sharing a common tenet of ethics.

Many approaches are now being pursued to restore public trust of businesses. Corporate social responsibility has become a cornerstone for the operation of businesses worldwide, small and large. It is reassuring to note that much of the modern glossary for business methods is in fact based on solid business precepts already in use. Common sense and the demonstration of ethical leadership underpin these principles, as outlined above. Yet, the differences between corporate social responsibility and acting unethically and illegally are not always distinct. Sometimes there is a fine line between them, a “gray area” where decision-making merges the two sectors or crosses over the boundaries. When officers or directors of a corporation violate their fiduciary responsibility, they are acting outright illegally, breaking laws and regulations, taking advantage of weak corporate controls, oversight, and accountability. Most greed and corruption emanate from top management and their co-conspirators, leaders of the company. So, as we move forward to restore public trust and establish universal common business principles, these law breakers need to be brought to justice.

2000 © Hellenic Communication Service, L.L.C. All Rights Reserved.

http://www.HellenicComServe.com

|