|

||||

No words can accurately describe the current financial meltdown. The non-ethics of the bailout plan defies belief. As a former investment banker, I can attest to the fact that few, if any people, truly understand the pricing and risk implications of many financial instruments, let alone the financial system. Worse still, the interconnectedness of the markets and the financial leverage of banks assets exceed even ludicrous numbers. Would your bank lend you money based on a 1:100 asset to liability ratio? Yet this is what many financial institutions’ balance sheets look like. One asks: Where is the SEC that supposedly reviews company quarterly filings? Where are the auditors who sign off annual financial statements that imply organizations are going concerns? What about the supposed checks and balances of Sarbanes-Oxley that has already costs the taxpayer billions of dollars? Our system has lost its way. Really tough measures and true moral courage is what we now need to swallow some rather bitter medicine. |

||||

| Let us look at what is on offer and the ethical implications: Good faith taxpayers who invested their money in financial institutions, are now being asked to cough up for losses incurred largely as a result of a combination of aggressive greed for market share; negligence, incompetence and in some cases downright corruption and fraud. I predict the extent of the latter is going to blow our socks off! So we have faithful vineyard owners compensating lax, incompetent and deceitful stewards! This goes far further than turning the other cheek or walking the extra mile! The incompetent stewards, notably senior management in the financial institutions and oversight bodies, are going to be bailed out. The losses they incur are going to be minimized. Incompetence, greed and crime pays! |

|

|||

| The bailout funds are going to be handed over to and administered by the very institutions whose poor oversight led to the problems in the first place. Wall Street provides the career pipeline for many people in the Fed, Treasury and SEC. Many members of the Treasury and the Federal Reserve hail from Wall Street or have strong Wall Street connections. Who is going to bite the hand that feeds them? Talk about conflicts of interest! So we have people who got us into this mess in the first place and whose competence is questionable, given the money to fix it, where their position is riddled with conflicts of interests. So we have no independence, minimal objective oversight, and lack of arms length controls. |

||||

|

Now, what about consequences for our incompetent stewards? They have already banked or invested their $5, 15, or $30 million somewhere safe. It does not matter if they lose their jobs. They have their two or three houses, their paintings and their jets. Yet, they even balk at the prospect of future limitations to CEO pay! What about penalizing them now? Let them sell some of their houses and other squirreled away assets and contribute this to the bailout fund. What about a record of all senior management in organizations needing a bailout? Transparency? |

|||

In truth, no-one knows the amount required to prop up our financial system that no longer bears in relation to true asset prices. Given that only one institution, AIG, has already cost $85 billion in prop up funds (and then there is Washington Mutual, Lehman Bros, Merrill, not to mention the unravelling of the European and Asian banks), we have NO idea what is needed to stabilize the system. The truth is that we have lost our way. Excessive credit, overcapacity in the market, and speculation that promises an infinite upside with only a limited downside, has led to greed and a loss of any kind of limits. Ethics is about limits. No limits – no ethics! In sum the non-ethics of the bailout lacks a return to competence; assurance of independence; a check on conflicts of interest, a lack of justice; no consequences for the perpetrators, and little resonance with reality. Our financial system needs to be taken apart and rebuilt on rock and not moral slippery sands. Using fear to rush this bill through, without prudential thought and wisdom, is going to cost everyone way, way more than $700 billion! |

||||

*These comments do not reflect the official position of any administrator or member of the faculty at Southern New Hampshire University. Annabel Beerel MBA, Ph.D Christos and Mary Papoutsy Distinguished Chair in Ethics Southern New Hampshire University September 30, 2008 |

||||

|

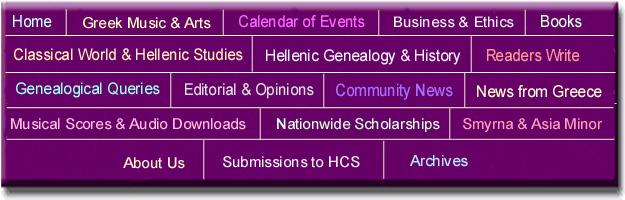

(Posting date 05 October 2008) HCS encourages readers to view other articles and releases in our permanent, extensive archives at the URL http://www.helleniccomserve.com/contents.html. |

||||

|

||||

|

2000 © Hellenic Communication Service, L.L.C. All Rights Reserved.

http://www.HellenicComServe.com |

||||