|

||

|

VAT on Houses to Fight Fraud Athens News |

||

|

The government hopes to boost its stagnant fiscal revenue by forcing builders to pay VAT on their lucrative property 'swaps' with home buyers while raising 'objective' land values By Dimitris Yannopoulos

|

||

| Delayed for nearly 20 years, the introduction of VAT in the booming real estate market on November 25 promises to strike at the heart of rampant tax evasion and bolster the state's sagging fiscal revenues. The long-overdue draft legislation tabled in parliament for ratification in mid-December seeks to crack down mainly on the tens of thousands of tax dodgers in the housing construction business and, indirectly, to attract large-scale investment in the sector that will further boost tax receipts, said Finance Minister George Alogoskoufis. |

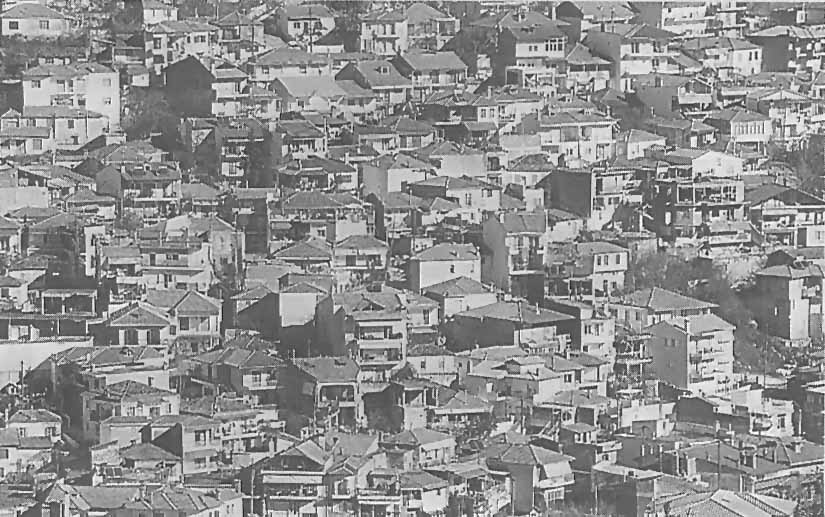

Lucrative mosaic: New homes are mushrooming around the country as buyers and builders seek to preempt the introduction of VAT in the real estate market on November 25 |

|

|

While first-time house buyers will be exempt from the tax, the 19 percent surcharge will be paid by property owners to construction firms which, in turn, will pay the VAT to the state. This way, the government believes that contractors will be forced to hold down the final prices of property sold- back to land-owners in exchange for the land on which they will build apartment blocks. This property-swap (antiparochi) is the principal method of real estate transactions in Greece, allowing widespread tax evasion through fictitious property price declarations "Curbing tax fraud in real estate may cut the black economy by a half over the next five years, allowing large-scale town planning and investment in a previously anarchic and chaotic market," said market analyst Chrysanthos Lazarides. "The collective power of the housing engineers' lobby has prevented the implementation of this measure for 18 years," he told the Athens News. Capital gains tax Transfers of properties acquired after 1 January 2006 will be subject to a graduated capital gains tax, whose rate depends on the number of years the seller owned the property before selling. Thus, the tax rate is 20 percent for owners selling a property after ownership of up to five years; 15 percent if the ownership period was from five to 15 years; 5 percent if it was from 15 to 25 years; and 0 percent if "the seller owned the property for over 25 years. Property buyers, who until now paid up to 11 percent of the property's value as transfer tax, will henceforth pay only a 1 percent tax called a transaction fee. The new bill also increases the tax-free portion of inheritances or parental transfers of property from 20,000 euros to 80,000 euros and extend the payment time for inheritance taxes from 24 monthly instalments to 24 bimonthly ones. While the VAT is imposed on the contractors, there is concern that the cost may be passed on to property owners if the so-called "objective values" - indicative property value set by law for taxation purposes-which always lag actual market values, increase over 15 percent in 2006. These values, which differ according to location, are the ones on which property taxation is based. The VAT will be based on those values as well. "If objective values rise by 50 percent next year, we may see a real estate market crash as small buyers will cancel their housing investment plans," Lazarides said. Alogoskoufis sought on November 25 to calm taxpayers, saying that the rise in objective values will only be slight. Tax eligible and exempt The main provisions of the legislation are the following: The amounts exempted from income-tax for the acquisition of a first house are raised to 75,000 euros for unmarried individuals and to 115,000 euros for childless married couples. For the latter, this amount is raised by 23,000 euros for each of their first two children and by 35,000 for each child after that. The tax-exempt portion of property transfer from parents to their children or from one spouse to another is raised from 20,000 to 80,000 euros. In the case of property transfer to children, the portion of the property value ranging from 80,000 to 100,000 euros is taxed at half the standard rate. |

||

HCS readers can view other excellent articles by the Athens News writers and staff in many sections of our extensive, permanent archives, especially our News & Issues, Travel in Greece, Business, and Food, Recipes & Garden sections at the URL http://www.helleniccomserve.com./contents.html

All articles of Athens News appearing on HCS have been reprinted with permission. |

||

|

||

|

|

||

|

2000 © Hellenic Communication Service, L.L.C. All Rights Reserved. http://www.HellenicComServe.com |

||